Introduction – From Generic Maker to Global Innovator

India’s pharmaceutical industry has long been recognized as the “Pharmacy of the World.” In 2025, this title has evolved from a manufacturer of affordable generics to a global leader in drug innovation, R&D, biotechnology, and exports. With the government’s strategic policies and the private sector’s expanding capabilities, India is not just keeping pace — it is setting the pace in the global pharmaceutical market.

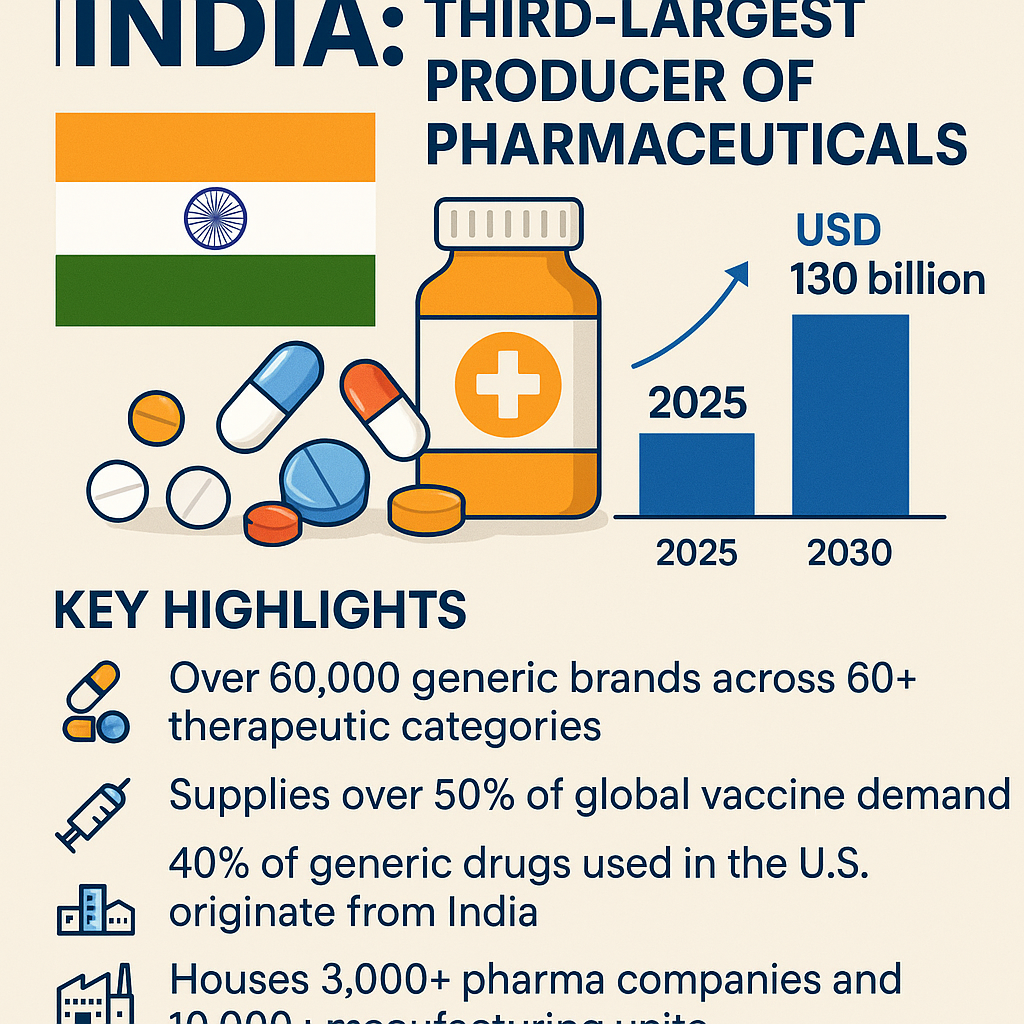

A Snapshot of the Indian Pharmaceutical Industry in 2025

India is the third-largest producer of pharmaceuticals by volume and tenth by value. In 2025, the industry is estimated to be worth over USD 65 billion, with expectations to cross USD 130 billion by 2030.

Key Highlights:

- Over 60,000 generic brands across 60+ therapeutic categories

- Supplies over 50% of global vaccine demand

- 40% of generic drugs used in the U.S. originate from India

Houses 3,000+ pharma companies and 10,000+ manufacturing units

Government Initiatives Fueling Growth

1. Production Linked Incentive (PLI) Scheme:

The Indian government launched the PLI Scheme to boost domestic manufacturing of critical drugs and Active Pharmaceutical Ingredients (APIs). As of 2025:

- Over 70 new manufacturing plants for bulk drugs are operational

- Incentives offered to over 50 pharma companies

- Focus areas: KSMs, APIs, drug intermediates, and high-value generics

2. National Health Mission and Ayushman Bharat:

These programs have led to an increase in medicine accessibility and affordability. Indian pharma companies are now deeply involved in public-private partnerships, ensuring supply to rural and under-served areas.

3. Digital Health & E-Pharmacy Boost:

The National Digital Health Mission (NDHM) has encouraged the rise of e-pharmacies like 1mg, NetMeds, and PharmEasy. These platforms make drug access seamless, especially in Tier II & III cities.

Export Boom – India’s Pharma Goes Global

India’s pharma exports reached an all-time high in FY 2024–25, crossing USD 28 billion.

Major Export Destinations:

- United States

- United Kingdom

- South Africa

- Russia

- Latin America

- Southeast Asia

India’s strength in generics, biosimilars, and vaccines makes it indispensable to global supply chains.

New Market Penetration in 2025:

- Expanding to Middle Eastern countries

- Bilateral trade agreements with African nations

- Growth in Latin American regulatory approvals

India’s Vaccine Manufacturing Supremacy

India continues to be the largest vaccine producer in the world in 2025.

Leading Players:

- Serum Institute of India: Manufacturing vaccines for HPV, malaria, and COVID-19 variants

- Bharat Biotech: Known for Covaxin, now focusing on intranasal vaccines

- Biological E: Developing mRNA-based vaccines

India contributes to 65% of WHO’s vaccine procurement for low- and middle-income countries.

Innovation & R&D: Moving Beyond Generics

While generics still account for a significant share, R&D investments have surged.

Major Trends:

- Biologics and biosimilars R&D

- Focus on oncology, rare diseases, and immunotherapy

- Collaboration with AI firms for drug discovery

- Growth in clinical trials and CROs (Contract Research Organizations)

Pharma majors like Sun Pharma, Dr. Reddy’s, and Zydus Lifesciences have increased R&D spending by over 30% compared to 2022.

Biopharma and Biosimilars – The Next Big Leap

India is becoming a hub for biosimilars, which are cost-effective alternatives to biologic drugs. In 2025:

- India ranks third globally in biosimilar development

- More than 30 biosimilars approved for global markets

- Active licensing deals with Europe and North America

The focus on monoclonal antibodies, insulin analogs, and blood factors is expanding treatment options at affordable prices.

API Independence and Bulk Drug Parks

The COVID-19 crisis exposed India’s dependence on China for APIs (Active Pharmaceutical Ingredients). In response:

- India launched 3 bulk drug parks (in Gujarat, Himachal Pradesh, Andhra Pradesh)

- Domestic production of critical KSMs and APIs has grown by 70%

- Companies like Aarti Drugs and Granules India are scaling operations

This push has improved cost competitiveness and supply chain resilience.

The Rise of Indian Pharma Startups in 2025

A new generation of healthtech and biotech startups is changing the landscape.

Notable Names:

- Bugworks: Working on novel antibiotics

- Mylab Discovery: Known for diagnostic kits

- Eyestem: Developing regenerative therapies for blindness

- MolBio Diagnostics: Innovations in molecular diagnostics

Supported by incubators, angel investors, and government grants, these companies are making global headlines.

Global Recognition and Partnerships

Indian pharma companies are forging international collaborations like never before:

- Licensing deals with Pfizer, Roche, and Novartis

- Vaccine production partnerships with Africa CDC

- Joint ventures for mRNA technology transfer

These alliances are solidifying India’s role as a trusted manufacturing and research partner.

Challenges to Overcome

Despite the success, some hurdles remain:

- Regulatory harmonization with developed markets

- Shortage of skilled talent in biotech R&D

- Ensuring quality control across decentralized units

- Rising competition from China and emerging Asian markets

The Government of India and pharma associations are addressing these through reforms, training programs, and regulatory digitization.

What the Future Holds

India’s pharma growth in 2025 is just the beginning. The path ahead includes:

- Expanding vaccine diplomacy

- Scaling AI-based drug discovery

- Entering high-margin biologics markets

- Strengthening the domestic health ecosystem

If the momentum continues, India is poised to become the #1 pharma exporter globally by 2030.

FAQs – India’s Pharmaceutical Industry in 2025

1. What is the current size of the Indian pharma market in 2025?

As of 2025, India’s pharmaceutical market is valued at over USD 65 billion, with projections to double by 2030.

2. What is the PLI scheme and how does it help pharma companies?

The Production Linked Incentive (PLI) scheme provides financial incentives to manufacturers for producing APIs, KSMs, and advanced pharma products within India to reduce import dependency.

3. Which Indian companies lead in vaccine production?

Top players include Serum Institute of India, Bharat Biotech, and Biological E, all of which export globally and supply to WHO programs.

4. How is India improving its R&D capabilities?

Indian pharma is increasing investment in biologics, AI-powered drug discovery, and collaborations with research institutions and global firms.

5. What are biosimilars and why is India investing in them?

Biosimilars are low-cost alternatives to biologic drugs. They are a major focus for India because they offer high export potential and address affordability challenges in global markets.

6. Is India still dependent on China for APIs?

Dependency has significantly reduced due to government policies and domestic bulk drug parks. India now produces many critical APIs locally.

7. How does India compare with China in pharma?

India leads in generics and vaccines, while China focuses more on chemicals and ingredients. India is quickly catching up in biotech and innovation-driven pharma.

Conclusion – India’s Pharmaceutical Future Looks Bright

India’s pharmaceutical journey in 2025 reflects resilience, innovation, and global leadership. With a strategic shift from generic focus to cutting-edge R&D and biologics, India is not just a major player — it is a future superpower in the pharmaceutical industry.

As policies, infrastructure, and private initiatives align, India is not only serving domestic health needs but also shaping global healthcare for decades to come.